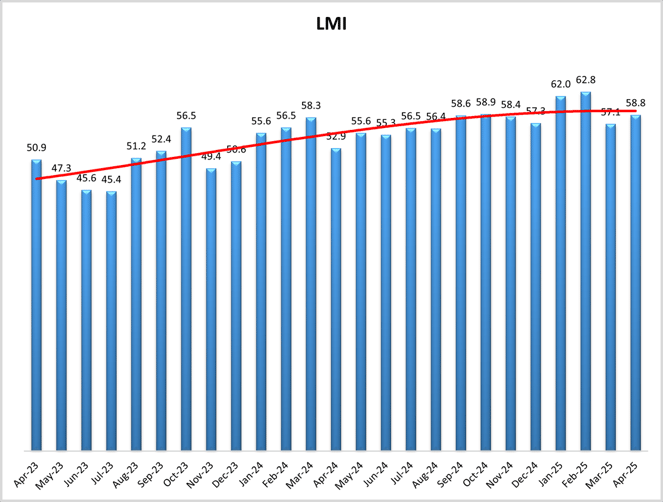

The good news is, the April Logistics Managers' Index (LMI) bounced back a bit from its dip the month before, rising 1.6 to 58.8. The bad news is, why - as key indicators suggest the inventory pull-forward that's been occurring to avoid tariffs has mostly already happened - and products are starting to fill warehouses without moving on to consumers.

Those indicators are Inventory Costs - which went up five points to 75.6, and Warehousing Prices, which had an even more drastic jump of 11.2 to 72.3. Inventory Levels, a metric that typically coincides with Costs, actually dropped 4.2 to 57.1. This dynamic suggests products won't be moving as much now that they've been staged to beat tariffs, leading to a higher cost of storage and a lower amount of shipping.

Interestingly, Warehousing Capacity was up 3.1 to 55.4 - suggesting more is coming on the market. Warehousing Utilization meanwhile, only grew 0.4 to 60.1, suggesting there is still room for more inventory if it's needed.

Like the index overall, transportation numbers looked better last month after a rough March, as Transportation Prices rose 5.8 to 62.3, while Transportation Capacity had more modest growth of +1.6 to 55.2 - stretching the gap between the two metrics to a healthier seven points after it had narrowed to less than three. Transportation Utilization though, fell 0.7 to 53.3, suggesting again, that shipping may be slowing down.

Much is still dependent on how the economy (and tariff policy) shakes out, as authors point out consumer spending and job creation numbers are still ok, but the outlook for inflation, interest rates and imports suggest that behavior may not last.

With continued uncertainty, logistics pros kept their predictions for the future of the market measured. The 12-months-from-now LMI came in even with last month, at 60.6. Respondents expect Inventory Costs to continue to rise while Inventory Levels will remain rather stagnant. On the positive side, they project Transportation Prices to jump considerably to 72.3, dwarfing Transportation Capacity at 53.4.

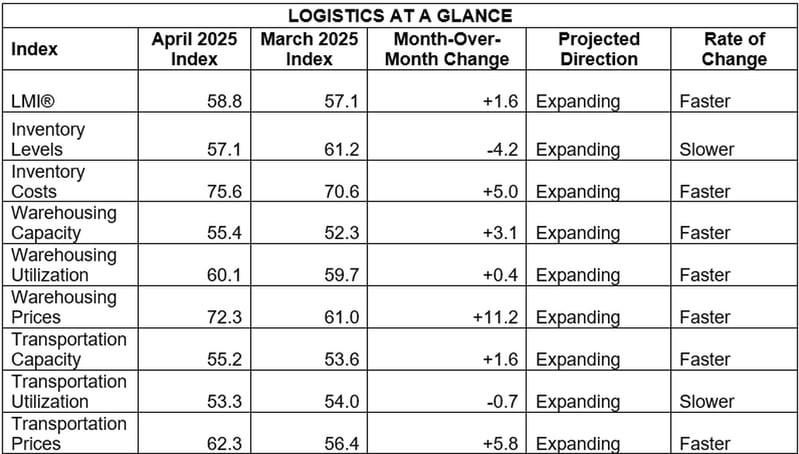

By the Numbers

See the summary of the April 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in April 2025.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.