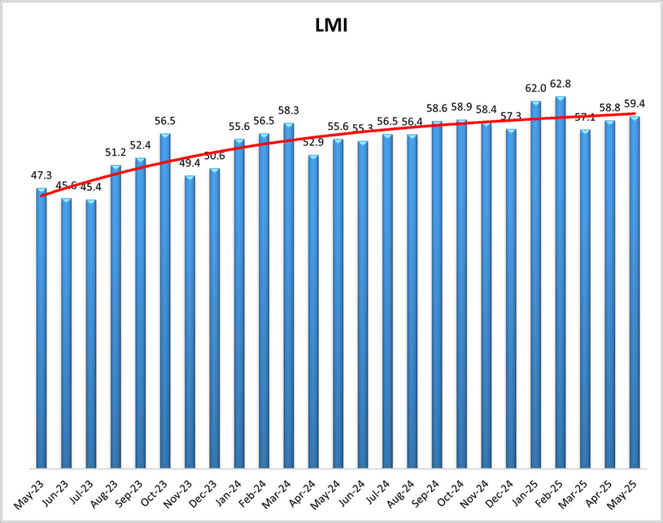

For the second straight month, the Logistics Managers' Index (LMI) has ticked up after a dip to start Spring, rising 0.6 in May to 59.4. The increase to keep it firmly in expansion is driven by increases in two major supply chain cost metrics, Inventory Costs and Transportation Prices, even as volume has slowed.

Diving deeper, Inventory Costs rose to their highest reading since October 2022, gaining 2.8 to 78.4. Inventory Levels on the other hand fell 5.5 to a just-into-expansion level of 51.5, suggesting inventories were moved into the country early to beat tariffs, and they're now expensive to store. The gap between the two inventory measures is the third largest in the LMI's history - and the point is underlined by Warehousing Capacity as well, which dropped 5.4 to an even 50 - indication neither expansion or contraction. Warehousing Prices incidentally dipped 0.2 to 72.1, largely due to that lack of capacity.

Onto the transportation side, Transportation Prices remained among the highest metrics, at 63.1, with the gap between Transportation Capacity at just under 9 as it read in at 54.7. That gap is a little tighter than ideal, but it's still hanging on in the right direction. Transportation Utilization at 52.6 is at its lowest level since November 2023 - harkening to those inventory and warehousing metrics that suggest movement was not the strongest in May. All three transportation measures moved less than one point last month, with Prices up 0.8, while Utilization was down 0.7 and Capacity off 0.5.

On the future front, there was significant optimism about where the market will stand a year from now. Respondents project the LMI in May 2026 to read at 65.1, up 4.5 from April's 12-months-away expectations and above the all-time average for the first time since February. The prediction is driven by a combination of expanding Inventory Levels, Inventory Costs, Warehousing Prices and Transportation Prices - all suggesting logistics pros are expecting tariff-related uncertainty to find a resolution over the next several months.

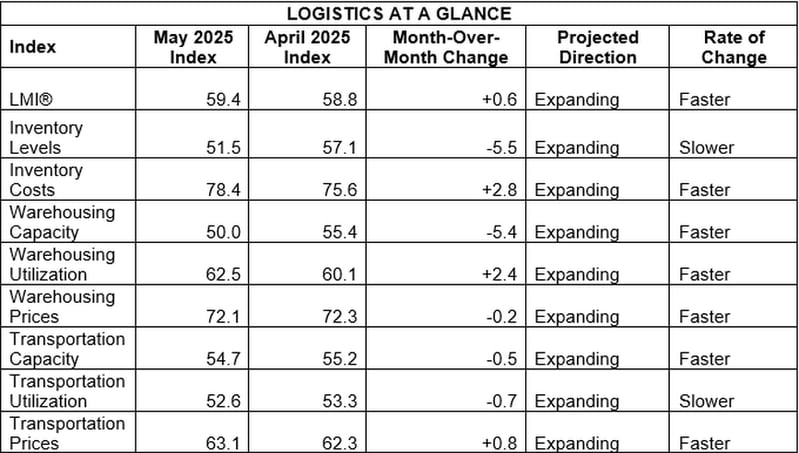

By the Numbers

See the summary of the May 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in May 2025.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.