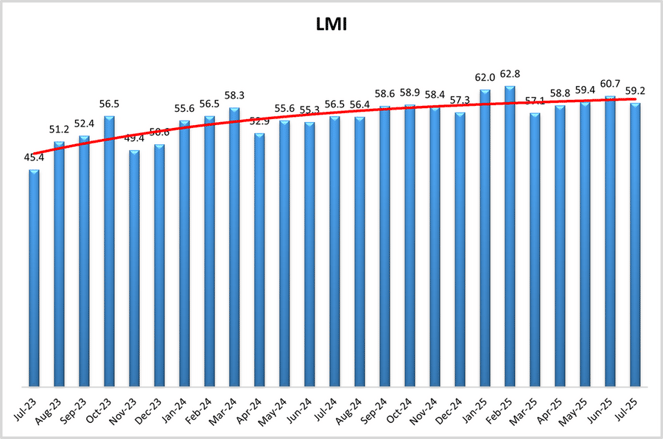

After three straight months of gains, July's Logistics Managers' Index (LMI) slowed down a bit, falling back below the 60 threshold (-1.5) to an overall reading of 59.2. The main drivers of the recent upticks were also the culprits behind easing expansion last month: Inventory Levels, Inventory Costs and Warehousing Utilization.

Standing out among those metrics in July was Inventory Costs, which fell 9 points to 71.9. Inventory Levels also saw a decline of 4.2 to 55.2. Warehousing Utilization, too, fell back 2.8 to 59.4. While all three numbers (especially Inventory Costs) remain in healthy expansion, the drops are notable - and indicate another likely tariff-related pause in inventory activity. They coincide with a gain in Warehousing Capacity of 3.3 points, which moves it back into expansion at 51.1. The overall direction of these metrics remains uncertain as trade policy continues to evolve and the health of the economy shows mixed signals.

On the shipping side, Transportation Utilization was the fastest riser of all the metrics in July, up 6.6 to 59.5. Transportation Capacity was largely flat, up just 0.2 to 52.6. Transportation Prices gained 1 point to 63 - marking about a 10 point gap between the two indicators. Authors point out though, that capacity needs to dip below 50 (and into contraction) to signify any true freight market boom.

An overall theme of July's report was the difference between larger and smaller firms. Companies with under 1,000 employees saw much more action, fueling the continued expansion of the index (which would've read at 62.1 just for them) with continued higher inventories and tighter capacity. Larger firms would've read in at 56.2, with inventories actually contracting and more capacity available.

Looking to the future, optimism levels for a year from now fell about as much as the overall index month to month. In July 2026, respondents predict the LMI will read at 62.6, off 1.9 from June but still above the index's all-time average. The lower expected rate of expansion relates to lower expectations of Inventory Levels, Inventory Costs and Warehousing Prices, as well as a big bump in Transportation Capacity.

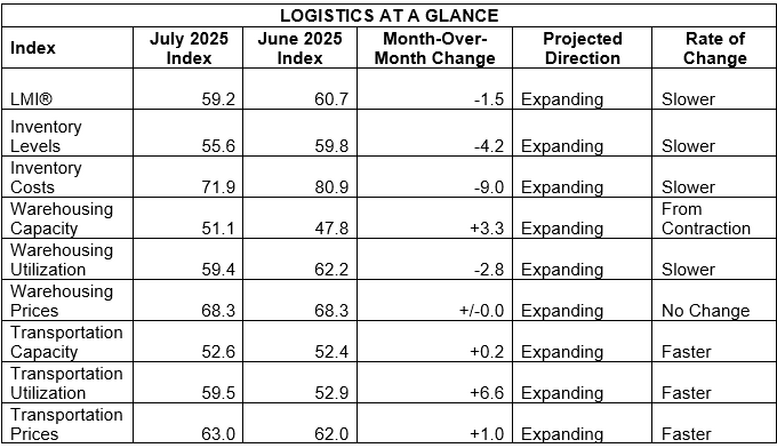

By the Numbers

See the summary of the July 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in July 2025. Learn more about the index on our podcast with its primary author Zac Rogers, Ph.D., associate professor of Supply Chain Management at Colorado State University.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.