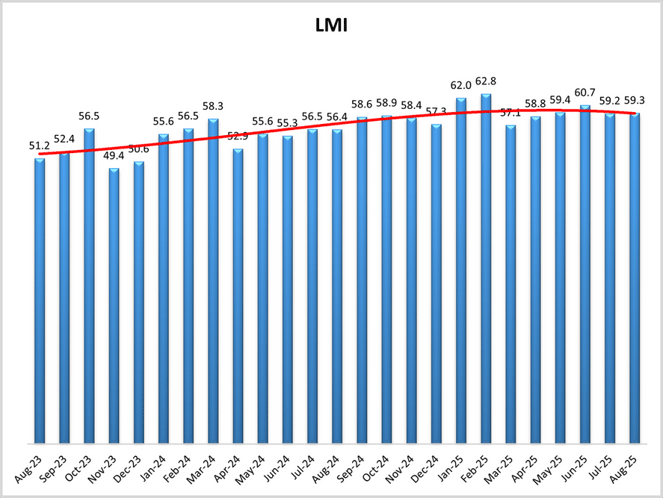

Longtime followers of the Logistics Managers' Index (LMI) know that one indicator of a healthy industry is a gap between Transportation Prices and Transportation Capacity, with the former leading the latter. So the August LMI, which has the gap not only shrink, but invert - with prices falling below capacity, would not necessarily represent a positive development. The overall index last month ticked up 0.1 to 59.3, but transportation was the story.

Transportation Prices fell 6.9 to 56.1, while Transportation Capacity gained 4.7 to a reading of 57.3. Both are still expanding, but authors note prices falling below capacity's rate of expansion marks a "mild negative freight inversion." In fact, it's the first time since April 2024 where the metrics were ordered this way. Authors caution that while inversions like this in the past have indicated the beginning of a freight recession, readings like this would need to continue for a few consecutive months to declare such a scenario starting again.

The disappointment for many in the industry stems from the fact that it looked as if the market was shifting as last year ended and this year began. After January though, the +17.7 reading of prices vs. capacity has generally headed back down to now reach this point, with authors suggesting August's timing as the typical start of peak season coming in at this level indicates no boom market in sight anytime soon. The other transportation metric, Utilization, also fell, dropping 4.8 to 54.7, suggesting a slowdown in volume of freight movement.

Keeping the overall LMI ticking slightly positive and close to its all time average of 61.5 though, is a combination of its other metrics covering inventory and warehousing. Inventory Costs saw the largest jump last month, rising 7.3 to 79.2, while Warehousing Prices were not far behind at 72.2 (+3.9). Inventory Levels rose 2.7 as well to 58.2, while Warehousing Capacity fell 0.6 to a just barely expanding 50.5.

The higher Inventory Levels and tightening Warehousing Capacity (with those higher costs) suggest most imports are already here - jibing with the idea that companies were pulling forward to beat tariffs as much as they could and have basically finished pulling. Other factors LMI authors are watching are how consumers may start to see tariff effects, the end of the de minimis exception and the legal battle over tariff authority, which saw a ruling against the Trump Administration last week.

So against that backdrop, what did respondents feel about the future of the index, specifically 12 months from now? Still optimistic - in fact moreso than July, with an expected reading up 1.3 to 63.9. That figure is driven both by a much different transportation picture than today, with an expected gap of +22.9 between prices (71.9) and capacity (49), suggesting respondents are expecting a much more active freight market along with continued high Warehousing and Inventory Costs - and tight Warehousing Capacity.

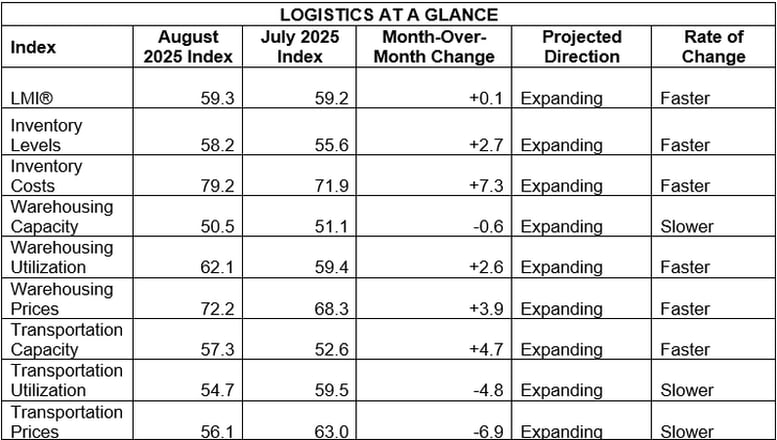

By the Numbers

See the summary of the August 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in August 2025. Learn more about the index on our podcast with its primary author Zac Rogers, Ph.D., associate professor of Supply Chain Management at Colorado State University.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.