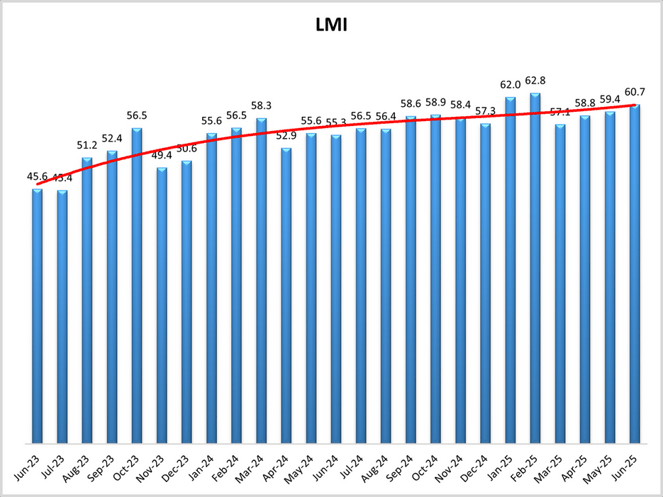

Even amongst market softness and other economic flags, June's Logistics Managers' Index (LMI) managed to make it three straight months of gains - coming in at 60.7, +1.3 from the month prior. It's just the third time in the past three years the overall LMI has surpassed 60, with all of those readings occurring this year. Inventory movement to beat the latest tariff deadline seems to be a primary driver of last month's upward movement, as Inventory Levels were up 8.3 to 59.8.

Inventory Costs incidentally, rose 2.5 to reach 80.9, its highest reading since October 2022 - the last time it surpassed 80. Relatedly, Warehousing Capacity dropped into contraction territory after starting the month at an even 50, now reading in at 47.8 (-2.2). Rounding out the metrics in this area, Warehousing Prices fell 3.8 to a still strong 68.3, while Warehousing Utilization ticked down 0.3 to 62.2.

It's important to note that the heaviest gains in Inventory Levels occurred during the first half of June, while things slowed considerably in the second half. The next tariff-pause deadline is this week, so what comes out of that date will likely influence freight going forward. One piece of good news, authors note, is that consumer sentiment increased 16% in June, indicating purchasers may help keep that built-up inventory from stagnating.

Onto the transportation metrics, one of which especially bears watching. Transportation Capacity fell 2.3 to 52.4 - only slightly into expansion. Authors note the last time it contracted was in March 2022, so a further drop would be notable. Transportation Prices were down 1.1 to 62, still firmly in expansion and maintaining about a 10-point gap with capacity. Transportation Utilization stayed roughly even, ticking up 0.3 to 52.9.

Beyond the more pressing issues of tariffs, short-term consumer behavior and Federal Reserve interest rate policy, respondents (as they always are) were asked to look forward a year to predict the logistics market next June. In this regard, their projection was off slightly (-0.6) from May, but still a solidly positive 64.5. The number is driven by pros expecting cost and price metrics to rise significantly with inventory levels remaining healthy.

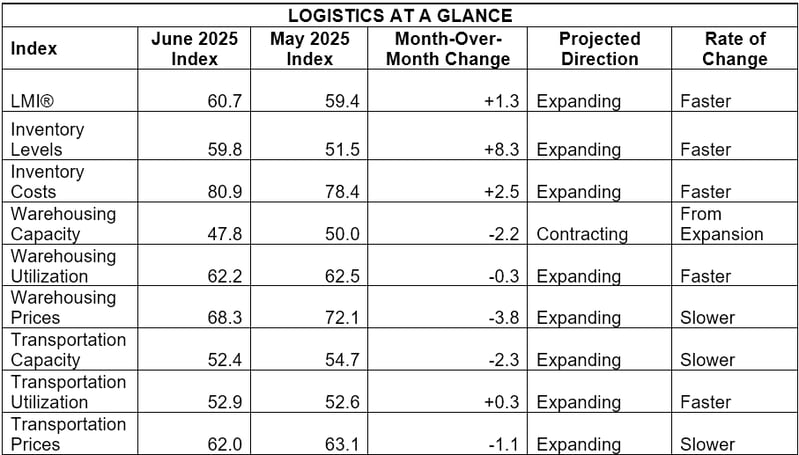

By the Numbers

See the summary of the June 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in June 2025. Learn more about the index on our podcast with its primary author Zac Rogers, Ph.D., associate professor of Supply Chain Management at Colorado State University.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.