Transportation Utilization was flat in September - a troubling sign when things should be humming along in peak shipping season - according to the latest Logistics Managers' Index (LMI). That metric fell 4.7 to an even 50, indicating no movement - something many in the industry would probably agree with. The reading is the lowest it's ever been in September, a month that typically sees utilization average 65.1 - well into growth.

Other transportation metrics are not doing much better, as Transportation Prices dropped 1.9 to 54.2 and Transportation Capacity was down 2.2 to 55.1. Capacity thus outpaced Prices for the second straight month, and Prices saw their lowest reading since April of 2024 (though it is worth noting that both are still in expansion territory for now).

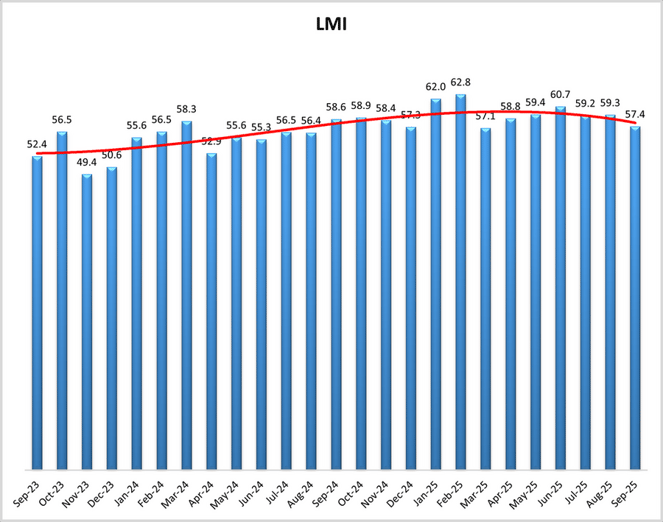

As for the overall index, the LMI in September came in at 57.4, 1.9 lower than the month prior and its lowest figure since March. And while Transportation is a major culprit behind the slowdown, Inventory metrics all saw decreasing growth rates as well - with Warehousing Prices and its drop of 6.3 outpacing them all.

Inventory Costs were -3.7 to a still quite high 75.5, while Inventory Levels fell 3.1 to 55.2. Authors suggest those numbers show a continued hesitancy by companies to stock up further after engaging in pull-forward activities for the first several months of the year. The Warehousing Price drop is also reflective of lack of new inventory coming in, though it maintains a high level similar to Inventory Costs.

The state of the LMI mirrors overall economic uncertainty according to authors. They cite weakening jobs numbers and consumer sentiment - which specifically relates to higher costs caused by tariffs, inflation or a combination of factors. The government shutdown is also factoring in to more limited economic activity, with 750,000 workers currently on furlough.

Looking ahead, optimism has slowed considerably for the market a year from now. Respondents predict an LMI of 59.6, off 4.3 from August's more August prediction. That number would remain below the index's all-time average of 61.5. The culprits in the drop from last month's projection are all cost-related, with transportation and warehousing prices, along with inventory costs all seeing declines of 5 or more points from their previous predictions.

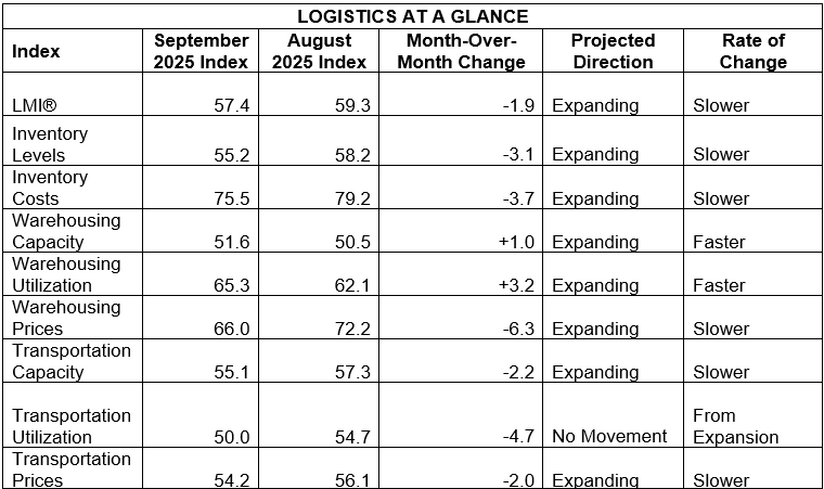

By the Numbers

See the summary of the September 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in September 2025. Learn more about the index on our podcast with its primary author Zac Rogers, Ph.D., associate professor of Supply Chain Management at Colorado State University.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.