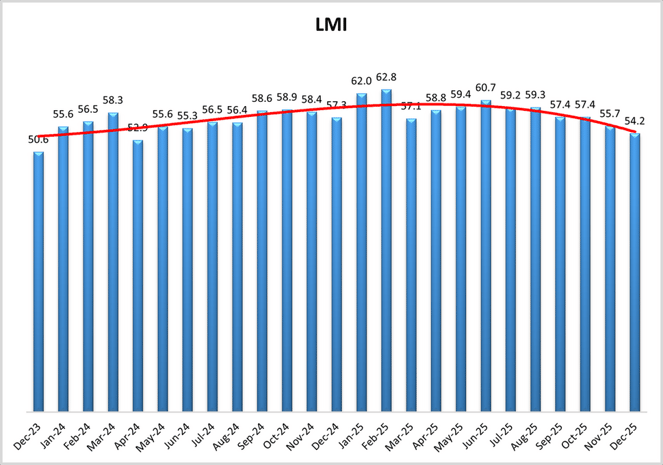

December's Logistics Managers' Index (LMI) brought 2025 to a close with its second straight decline, but transportation once again bucked the trend. The LMI finished the year dropping 1.5 points to 54.2, marking 10 straight months below its all-time average and two months in a row of falling numbers. In fact, since cracking 60 in June, it has seen a slow but sure downward trend. The transportation component though, is seeing positives for the second straight month.

Transportation Prices rose 1.8 to a reading of 66.7 - its highest reading since last January. Transportation Capacity, which already dipped in November, plummeted 13.1 points putting it well into contraction territory at 36.9 - its lowest reading in more than four years, and a nearly 30-point deficit versus the price metric. LMI authors point to holiday season delivery activity as the primary driver - even as some in the industry believe English-language crackdowns could be making a capacity impact as well.

Whether this transportation trend, which also saw Utilization increase 6.7 to 58.2, is purely seasonal will become clear in the next couple of months, but November and December saw strength in the freight market not seen in some time.

With those metrics strong, the reason for the overall LMI decline comes down to the other related contributors, Inventory and Warehousing. Inventory Levels fell a whopping 17.4 into contraction at 35.1, while Warehousing Utilization dropped 4.7 points, to an also contracting 42.9 (its second straight month reaching an all-time low). While inventories should be expected to drop as consumers spend for the holidays, authors point out that they're not replenishing as fast of late due to manufacturing and trade pressures limiting volume.

Warehousing Capacity correspondingly rose 6.4 to 61.2, while Inventory Costs fell 8.1 to a still expanding 62.9. Warehousing Prices remained high even with lower utilization and more capacity, rising 3.3 to 66.2.

Looking ahead, respondents expect the LMI to look better in 12 months - to the tune of 65.3. That's actually 2.4 points higher than last month's year-ahead prediction. Driving the stronger expectation is continued strength in the transportation metrics (Prices at 76.8 with Capacity at 40.5) along with expansion on the Inventory Cost and Pricing side - with Warehousing Prices remaining elevated as well.

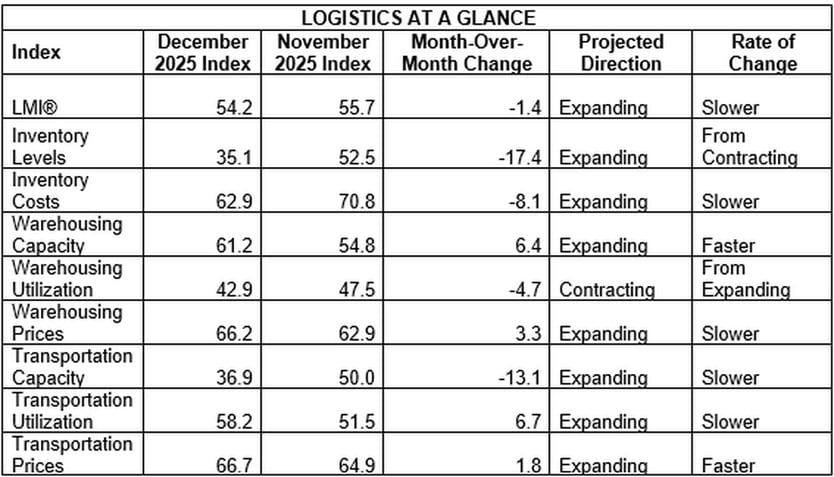

By the Numbers

See the summary of the December 2025 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in December 2025. Learn more about the index on our podcast with its primary author Zac Rogers, Ph.D., associate professor of Supply Chain Management at Colorado State University.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry.